a) NOK collapsed in Mar for several reasons :

1 - it’s perceived as a risk-on currency in what became an extreme risk-off environment (the traditional reason for collapses in Scandi FX);

2 - oil stocks were the epicentre of the equity sell off, as OPEC reinforced the effects of coronavirus. Offshore investors liquidated Norwegian oil stocks, and those that were unhedged on FX sold the proceeds from NOK into their home currencies. In the prevailing risk-off environment the FX sale helped to generate an extreme overshoot in the currency, breaking every historical level from the last 30 years.

3 - NOK has looked "cheap" for quite a while. I'd guess (it is a guess) that leveraged money was slightly long NOK at the start of the year, and was stopped out by the coronavirus selloff, adding to the selling pressure.

2 - oil stocks were the epicentre of the equity sell off, as OPEC reinforced the effects of coronavirus. Offshore investors liquidated Norwegian oil stocks, and those that were unhedged on FX sold the proceeds from NOK into their home currencies. In the prevailing risk-off environment the FX sale helped to generate an extreme overshoot in the currency, breaking every historical level from the last 30 years.

3 - NOK has looked "cheap" for quite a while. I'd guess (it is a guess) that leveraged money was slightly long NOK at the start of the year, and was stopped out by the coronavirus selloff, adding to the selling pressure.

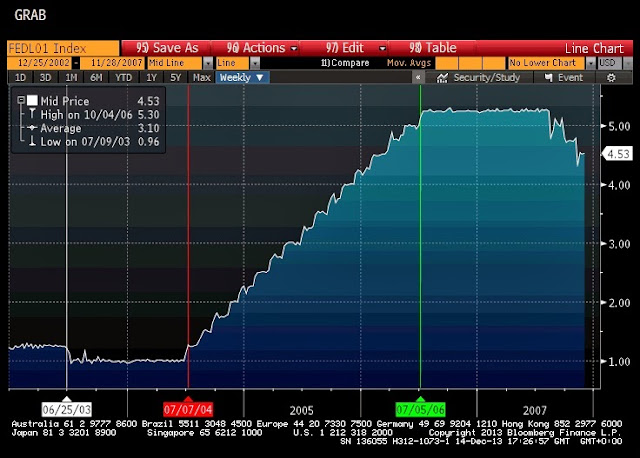

We got to 12 on USDNOK and 13 on EURNOK. Here are the long term charts :

b) Like everyone, Norway has now cut rates to zero, and opened the fiscal taps. Unlike other Western economies, they don't need MMT ("open-ended QE" as the central banks prefer to call it) to finance the spending. The Oil Fund holds NOK10trn ($1trn) of offshore assets, and the rules allows them to tap this to fund the extra spending. While everyone else is debasing their currency with MMT/QE, Norway is selling offshore assets and repatriating the funds, generating a bid for NOK in the process. Same disease, entirely different symptoms.

How big is this flow ? The budget deficit was NOK230bn last year, and looks likely to be NOK450-500bn this year. Ordinarily the government can use the Oil Fund's income (dividends and coupons) to finance the budget deficit, but in emergencies it can draw down the capital. This is the first time this has ever happened, and since the dividend yield on the equity portfolio has dropped, the capital drawdown will be significant. The relevant point for the FX market though is that the entire budget contribution from the Oil Fund has to be sold from foreign currencies into NOK. It looks likely to be NOK250-300bn higher than in previous years.

c) Norges Bank's governor, Mr Olsen, has said that they prefer not to cut from here ("We do not envisage making further policy rate cuts"), so a second wave or a further downturn in the economy should put all the burden on further fiscal easing. Although NOK will probably weaken on the headlines of any further stress, flows and fundamentals now point in the other direction. Liquidation of Oil Fund assets should turn NOK into a harder currency, in contrast to almost every other currency in the world. Further rate cuts are unlikely, and the distressed equity sellers have mostly been shaken out in March (in my opinion), so I'd argue that downside risks for NOK have fallen. For good measure, Norges Bank started making noises about intervention when NOK hit its lows in March. They don't want to see it there, and they have the firepower to back it up.

So there are 3 important points :

- NOK has been driven to 30 year lows by panic liquidation;

- drawdowns from the Oil Fund should strengthen the currency, unlike every other Western currency I know of;

- the potential downside risks for NOK (rate cuts and equity liquidation) seem much reduced, and further stress should see even more repatriation of Oil Fund assets into NOK.

To reduce p&l volatility and make the position more resilient (ie less risk-on) you could sell SEK and GBP against NOK.The Riksbank and Bank of England are both addicted to further QE, and in GBP’s case there's the risk of a harder Brexit (very real, in my opinion). Die-hard eurosceptics could sell EURNOK, hoping for a the “inevitable” eurozone breakup, and US election junkies can use USDNOK. Here are charts for GBPNOK and NOKSEK anyway :

Thoughts and opinions welcome.